A Europe-wide initiative to become the continent’s first carbon-neutral vanadium producer.

Vanadium is critical for Europe’s green transition and strategic autonomy. It is not yet produced in significant volumes in the region, without a reliance on non-European feedstock. Instead of mining for resources, we at Novana recycle industrial side streams into high purity vanadium in Pori, Finland, close to our Nordic supply chain.

The Ultimate Vanadium Market Report – Free Access to Exclusive Insights

What’s Inside?

- Global Supply Chain Deep Dive – Covers China, Russia, South Africa, Brazil, the U.S., Canada, Europe, Australia, and Kazakhstan.

- Exclusive Market Intelligence – Built on data from MPC, Project Blue, the World Bank, and other industry peers.

- Vanadium’s Strategic Role – Key insights into Vanadium Flow Batteries (VFBs), steel, aerospace, and chemicals.

- Legislation & Policy Impact – Covers EU, U.S., Chinese, Indian, Japanese, and Australian regulations shaping demand.

- Investment & Price Outlook – Market trends, historical prices, and future projections.

- Novana’s Competitive Edge – Assesses how Novana’s carbon-negative, innovative processing technology can secure Europe’s vanadium supply chain.

Download Now and gain a competitive edge in the vanadium market.

Vanadium The Key to Unlocking Sustainable Energy and Industrial Strength

Vanadium is vital for Europe’s green transition and strategic autonomy, yet it is not produced in significant volumes locally and depends on non-European feedstock.

As a crucial material for renewable energy, vanadium addresses the challenge of intermittency in wind and solar power. These energy sources require large-scale, long-duration storage to maintain a stable and reliable electricity supply, where vanadium plays a pivotal role.

Vanadium flow batteries (VFBs) offer a solution to this issue, providing utility-scale energy storage with unique advantages. VFBs can store large amounts of energy for extended periods, have a long lifespan of 20+ years without capacity loss, are non-flammable, and use electrolyte that is almost infinitely recyclable.

Additionally, vanadium’s use in strengthening steel supports the construction of renewable energy infrastructure. As demand for clean energy technologies grows, vanadium’s importance is expected to increase significantly.

According to the International Energy Agency (IEA) World Energy Outlook 2023 and IMF calculations, vanadium demand is projected to increase dramatically by 2050 under the IEA’s net-zero emissions transition scenario. Specifically, vanadium demand is expected to grow more than 8 times compared to 2022 levels.

We will be the world’s first carbon neutral vanadium producer and our innovative ecosystem contributes to the circular economy at large.

Vanadium fact sheet

As a transition mineral, vanadium enables the creation of two main compounds:

- 01 Ferrovanadium, making carbon steel stronger and lowering the carbon footprint of buildings

- 02 Vanadium pentoxide, used in steel applications and flow batteries to enable grid scale energy storage solutions for the green energy transition

Stabilized slag material (SSM) is produced as a byproduct of the recovery process and can be used as a carbon negative feed material in applications such as the production of cement and/or concrete for building products, land reclamation and soil treatment.

Despite being categorized as a critical mineral by the EU, vanadium is currently not being primarily produced in the region. For Europe to ensure strategic autonomy, lead the green transition and achieve the aims set in the Green Deal, we need to look at how materials and minerals crucial to our everyday lives are sourced. Because that’s where the transition starts. At the beginning of the value chain.

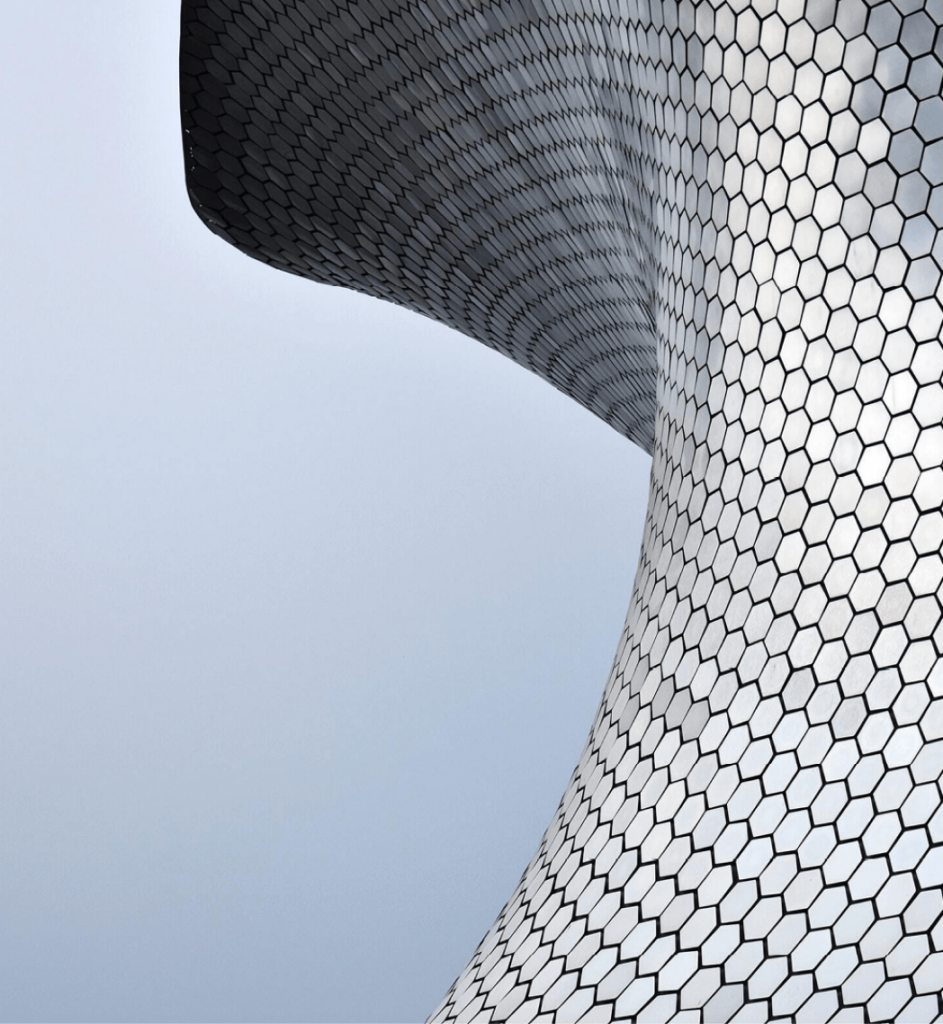

European ecosystem

Circularity is at the core of our entire business model. The creation of a closed-loop system where industrial side-streams are utilised to produce zero carbon vanadium requires a sophisticated ecosystem of partners who share our vision. Our facility, located in Pori, Finland, connects different European actors across the supply chain creating an environmentally sound and geographically efficient ecosystem. We are centrally located to numerous European steel mills, whose industrial side streams are our feedstock, as well as close to potential offtakers of our carbon negative by-product SSM.

Novana facility

-

Location

Tahkoluoto Port, City of Pori, Finland

-

Capital cost

~314M USD*

-

Operating cost

Lowest quartile

-

Indicative Construction timeline

H1 2025 – H1 2027

-

Throughput

up to 300k tonnes p.a.

-

Planned annual production ~9k tonnes V2O5

Planned annual production ~9k tonnes V2O5*

*For further information, refer to ASX release dated 8th March 2023 – Vanadium Recovery Project Delivers Strong Feasibility Results

Upcoming Project Catalysts and Planned Project Milestones

2025 Q1

- Detailed engineering and procurement work commenced

2025 H1

- Stockpile and pond earthworks completed

- Process area civil works begin (earthworks, concrete, steel, cladding)

- Critical packages procurement

2027 H1-H2

- Mechanical completion achieved

- Commissioning begins

2028 H1

- Pori facility in operation

Latest news

The team

Johanna Lamminen

CEO

- Highly experienced business leader and board professional

- Experience includes CEO of Gasum, CEO and CFO of Danske Bank Finland, CFO and deputy CEO of Evli Bank. Presently Board Member of Mandatum Plc, CellMark AB, Alisa Bank Plc, The Research Institute of the Finnish Economy ETLA and Finnish Business and Policy Forum EVA

- Previous Board positions at Sampo Plc, Cargotec Corporation, Tieto Plc, Evli Bank Plc

- Doctor of Science in Technology, MBA

- Key experience: Gasum, Pohjolan Voima, Tieto, ETLA, Danske Bank

Darren Townsend

COO

- Mining Engineer with 25+ years. development, mining and corporate experience including managing ASX and TSX listed companies

- Head of Vanadium, Neometals, a sustainable battery materials producer

- Key experience: Neometals, Rio Tinto, Sons of Gwalia, Peak Rare Earths, De Grey Mining